How small farmers in Africa can access credit for family farming and boost their production

Credit for family farming helps African smallholders improve yields, adopt new tools, and strengthen rural livelihoods sustainably.

Credit for family farming helps African smallholders improve yields, adopt new tools, and strengthen rural livelihoods sustainably.

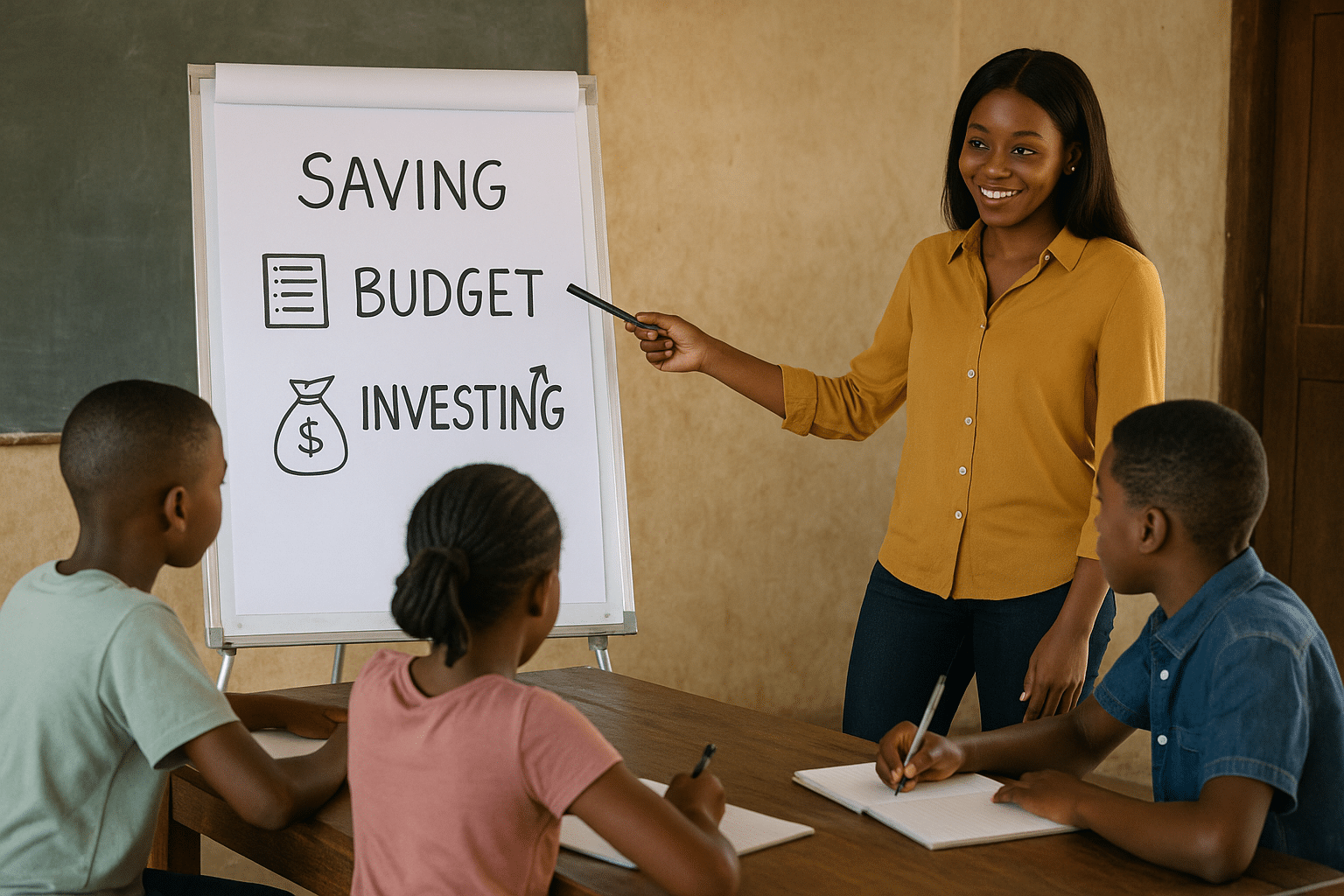

Empowering African youth through financial education to build resilience, equity and long-term prosperity across the continent.

Remittances are fueling economic growth and inclusion across Africa, empowering families, driving development, and shaping resilient economies.

African women entrepreneurs turn challenges into innovation with support systems, strong networks, and inclusive funding access.

Affordable housing trends are reshaping Africa’s real estate with new financing, ESG strategies, and urban development models.

Discover how savings and credit cooperatives in Africa provide accessible, inclusive financial services, empowering communities.

Discover how government financial assistance programs in Africa evolved, impacting economic growth, stability, and innovation.

Formalizing businesses in Africa requires tackling financial and bureaucratic barriers to unlock growth and sustainability.

Discover how population growth is reshaping personal finances and financial systems across Africa’s urban and rural regions.

Discover how digital payments in Africa are driving innovation, financial inclusion, and market growth in 2025.